VALUES.

Value Metaverse Backup Protocol

About Value

Value is the Metaverse Reserved Protocol on the Polygon Network depending on the $VALUES token. Each $VALUES token is backed by a resource chest (e.g. MAI, FRAX) in the Value store, providing a non-negligible fair value. The Value Protocol provides the possibility to support NFT tokens to storage liquidity. Value brings the monetary and hypothetical elements of the game to the market through tagging and holding. Value is part of a fork path for OlympusDAO with its own turn applied to NFT Bonding for the metaverse space and in light of the Polygon organization.

How does it work?

At a high level, Value consists of a protocol-managed treasury, protocol-held liquidity ( POL ), bond mechanisms, and wagering rewards designed to control supply expansion.

The sale of bonds generates profits for the protocol, and the treasury uses those profits to print $VALUES and distribute them to stakeholders. With liquidity bonds , the protocol can accumulate its own liquidity. See the entry below on the importance of POL .

Why do we need Value?

Dollar-pegged stablecoins have become an important part of cryptocurrencies due to their lack of volatility compared to tokens like Bitcoin and Ether. Users feel comfortable transacting using stablecoins knowing they have the same amount of purchasing power today vs. tomorrow. But this is a fallacy. The dollar is controlled by the US government and the Federal Reserve. This means the depreciation of the dollar also means the depreciation of this stablecoin.

Values aims to accomplish this by creating a free-floating reserve currency, $VALUES, which is backed by a basket of assets. By focusing on supply growth rather than price appreciation, Values hopes that $VALUES can serve as a currency capable of maintaining its purchasing power despite market volatility.

Is the coin VALUES stable?

No, $VALUES is not a stable coin. Instead, $VALUES aspires to be an algorithmic reserve currency backed by other decentralized assets. Similar to the idea of the gold standard, $VALUES provides a free floating value that the user can always reuse, simply because the fractional treasury reserve of $VALUES takes on its intrinsic value.

How can I profit from Value?

The main benefit for stakeholders comes from supply development. Beavers reap new $VALUES tokens from the repository, most of which are passed on to stakeholders who desperately need the $VALUES tokens they advertise. Furthermore, the gain for stakeholders will come from their automatic strengthening equilibrium, but value openness remains a significant consideration. That is, assuming the increase in the symbolic equilibrium outperforms the expected decrease in costs due to the expansion, the stakeholder will create a profit.

The principle benefit for bonders comes from the consistency of values. Bonders deliver capital openly and are guaranteed a reasonable return at the appointed time; the return is in $VALUES and in this way the bonder's profit will depend on the cost of $VALUES as the bond grows. Bonders benefit from rising or static $VALUES fees.

VALUES supported, not pegged.

Each $VALUES is backed by 1 MAI, not pegged to it. Because the treasury supports every $VALUES when it trades below 1 MAI. This has the effect of pushing the price of $VALUES back to 1 MAI. $VALUES can always be traded above 1 MAI because there is no upper limit set by the protocol. Think pegged == 1, while supported >= 1.

You can say that the minimum price of $VALUES or intrinsic value is 1 MAI. We believe that the true price will always be 1 MAI + premium, but in the end it is up to the market to decide.

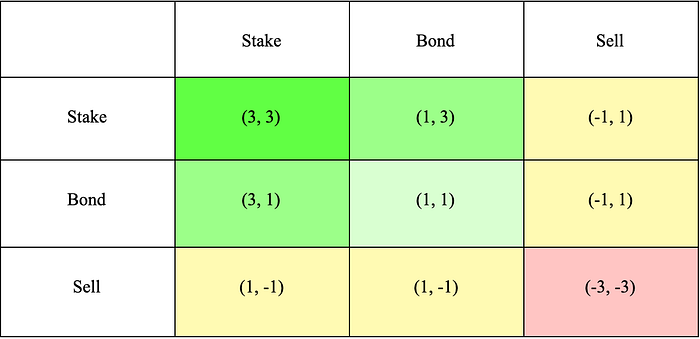

What's the deal with (3,3) and (1,1)?

(3.3) is the idea that, if everyone cooperates on Values, it will yield the greatest benefit to everyone (from a game theory point of view ). Currently, there are three actions the user can take:

Staking (+2)

Bond (+1)

Sell (-2)

Staking and bonding are considered beneficial protocols, while selling is considered a disadvantage. Staking and selling will also cause price movements, while bonding will not (we consider buying $VALUES from the market a prerequisite for staking, thus causing price movements). If both actions are profitable, the actor moving the price also gets half of the profit (+1). If the two actions contradict, the bad actor moving the price gets half of the profit (+1), while the good actor moving the price gets half of the loss (-1). If both actions are detrimental, meaning both actors sell, they both get half of the loss (-1).

So, considering the two actors, all the scenarios of what they can do and their effect on the protocol are shown here:

If we both stake (3, 3), it's the best thing for both of us and the protocol (3 + 3 = 6).

If one of us stakes and the other bonds, that's also great because staking takes $VALUES from the market and puts it into the protocol, while bonding provides liquidity and DAI for the treasury (3 + 1 = 4).

When one of us sells, it reduces the other person's effort to stake or tie (1 - 1 = 0).

When we both sell, it creates the worst outcome for both of us and the protocol (-3 - 3 = -6).

Further information:

Website: https://values.finance/

Twitter: https://twitter.com/ValuesDAO

Dispute: https://discord.gg/xdNKGffeY2

Telegram: https://t.me/valuesDAO

Sukabumie https://bitcointalk.org/index.php?action=profile;u=3198758

Komentar

Posting Komentar